By Rajni Bakshi

By Rajni Bakshi

MUMBAI—In an acutely ironic twist of history, the financial meltdown of 2008 coincided with the centenary year of Hind Swaraj (Indian Home Rule), a brief polemical tract written by Mohandas K. Gandhi. On the surface, the essay deals with questions of colonialism and independence. But within his arguments on those matters, Gandhi embedded a deeper, more universal message—that command over our passions is the essence of civilization. Throughout 2009, while business and political leaders scrambled to reboot the global financial system, scholars and activists in many nations met to reflect on the prescience of Gandhi’s text.

It warned of a danger more fundamental than mere “irrational exuberance” or the “animal spirits” of overconfidence that John Maynard Keynes saw at work decades later. Gandhi would have seen the crisis of 2008 as the inevitable unraveling of a “Black Age” which equates civilization with bodily comforts and advances in technology. “One has only to be patient and it will be self-destroyed,” he wrote in Hind Swaraj.

This critique might seem overblown to policymakers, economists, and politicians—many of whom focus on reviving a broken system based on the assumption that individual pursuit of self-aggrandizement, with ever-escalating needs and wants, is the motive force for progress. When used in this mainstream context, the term “recovery” evokes images of a reversal of plunging lines on graphs—of stock performance, employment, GDP. Alleviating such immediate symptoms would return us to the comfort zone of business-as-usual. But what if we momentarily free ourselves from the need to be emotionally restored to familiar ground or a safe home? What if we choose to consider the recovery from a different place—a retreat, or ashram, separate from, but parallel to, the current discourse on the global economic crisis?

That discourse is understandably dominated by political and ideological disputes. What caused the crisis? Who is to blame? What regulatory regimes can best ensure stability while simultaneously spurring the growth of business and trade? Yet, just as Gandhi used a treatise on Indian independence to explore basic questions about civilization, so may we use the global focus on “recovery” to ask a more fundamental question: How do we define value?

NUTURING VALUES

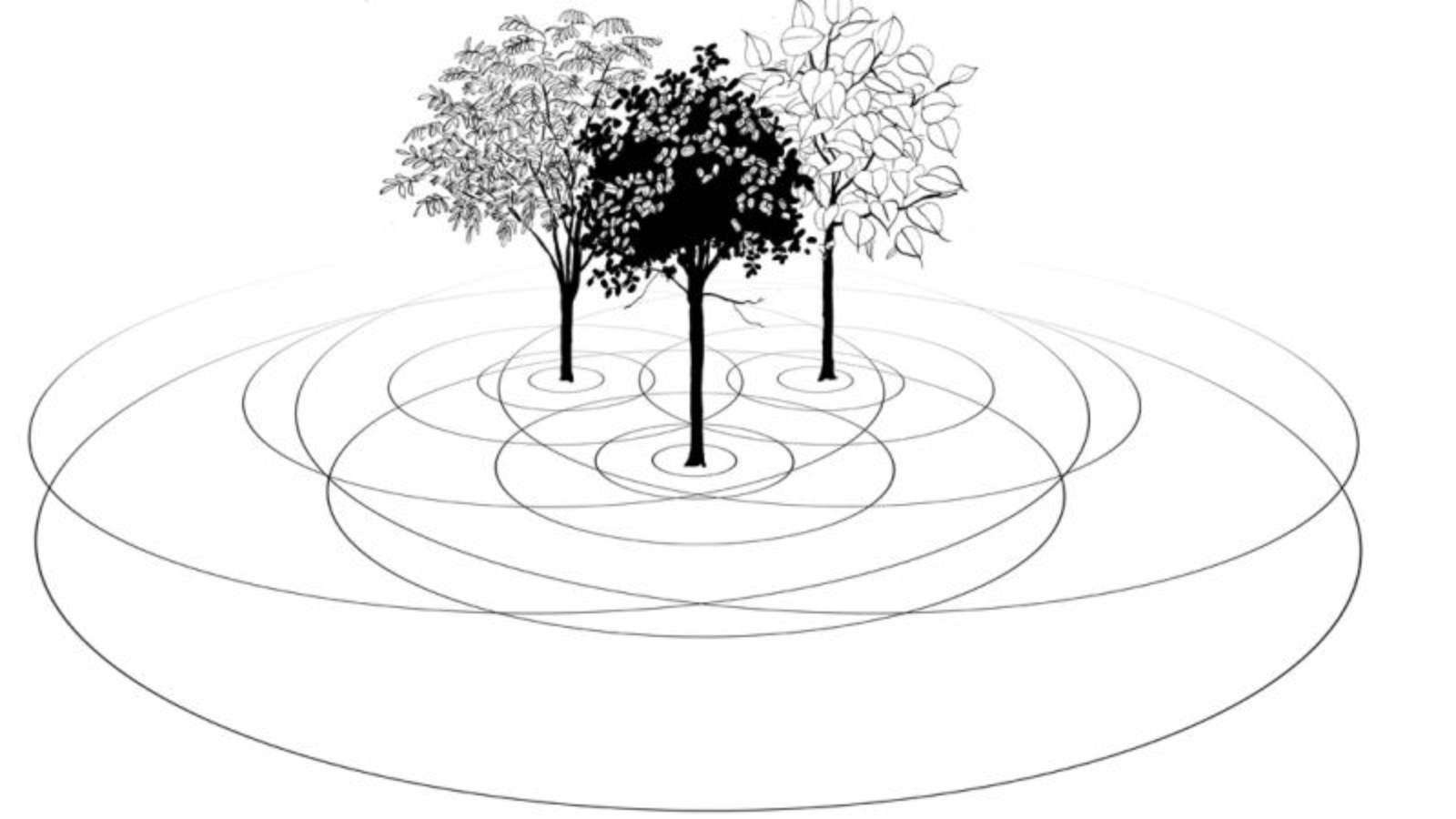

While traveling through the fields and uncultivated lands that slope towards the banks of the Narmada River in central India, a visitor is likely to notice, every so often, a recurring feature of the landscape—three trees, planted close together, each in different stages of carefully nurtured growth. Bamboo shavings are usually placed as a protective fence around a fragile peepal sapling, more commonly known as the sacred fig tree. Fully grown, the peepal forms a broad umbrella of translucent maple-like leaves which create a soothing musical murmur in a good breeze. A few feet away, a similar buffer may protect a neem plant, whose slim pointy leaves and bark have for centuries been used to make medicines and pesticides. And at some distance there will be a fledgling banyan, whose aerial roots and ever-expanding canopy of deep green leaves will one day provide cool shade from the merciless tropical sun. Usually, all three saplings have been planted by the same person. Bringing this trio of trees to maturity is an ancient practice that defines, or at least symbolizes, value and purpose. For some, completing this task is a way of justifying one’s existence—a payback for the bounty of nature. Others explain the plantings as a way of defining what really matters in life—simple joys rooted in nature’s cycles which simultaneously foster deeper spiritual awareness and fulfill practical needs.

When I see these plantings, I’m sometimes reminded of a story told by David Korten, the American activist-intellectual and author of The Post-Corporate World. Sometime in the mid-1990s, Korten had a brief conversation with the minister responsible for Malaysia’s forests. The minister, wrote Korten, “explained to me in all seriousness that since money grows faster than trees, Malaysia will be better off once it has cut down all its trees and put the money in the bank to earn interest. The image flashed through my mind of a barren and lifeless landscape populated only by banks—their computers faithfully recording interest payments on each of the accounts recorded on their hard drives.”

Over the years, I’ve shared both images—the trio of saplings and the extinction of Malaysia’s forests—with a wide range of people, and heard two kinds of responses. One is a call for revival of sustainable growth and an accompanying lament about the triumph of money over life. People who respond that way tend to be proponents of an egalitarian society organized around a restoration of ecological and cultural commons. The opposite response is to dismiss my account of the tree planting as romantic nostalgia for subsistence economies and to reject Korten’s tale as symptomatic of an anti-capitalist, anti-growth agenda that would ultimately leave hundreds of millions impoverished.

The jolt of 2008 encouraged more people—including me—to look beyond this conventional binary. I’ve come to see traditions like the tree-plantings as not merely examples of ecological sustainability, or overwrought symbols of an outdated resistance to global capitalism. Rather, I see them as a kind of civilizational code for simplicity that is the product of centuries of culture. The discipline and awareness required to complete the task of planting and nurturing seem to serve as a nucleus around which other aspirations are arrayed: making money, raising a family, enjoying life. This potentially makes it easier to separate needs from wants, allowing greed to be tamed rather than becoming the driving force of either individual lives or the marketplace. It is only then that value can be understood and defined in a holistic manner.

But how do we resolve difficulties that arise from the inherently subjective nature of valuation? One of Gandhi’s disciples addressed this problem directly. Joseph Cornelius Kumarappa was a Columbia University-trained economist who became a dedicated disciple of Gandhi in the 1920s and pioneered a theory of social and material well-being that is now somewhat awkwardly known as “Gandhian economics.” All of nature, Kumarappa observed, merges in a common cause. Nothing exists for itself. Value needs to be based on an objective understanding of the “permanent order of things,” namely the interdependence of all species with the biosphere and the atmosphere.

Today, the scientific understanding of interdependence—within human societies and between nature’s ecosystems and human production systems—is far more intricate. Whether this knowledge of our global interdependence can be transformed into a new basis for defining value is another matter. But there are a few tenuous signs of hope.

ENDING ENDLESS GROWTH

Concerns about the future of civilization don’t usually appear in analyses of business trends. Yet proponents of socially responsible investing (SRI) do, to some extent, slip these concerns into corporate board-rooms. Funds like Domini Social Investments and Calvert Investments apply social, environmental and ethical screens to channel the funds they manage. In the United States alone such funds are now estimated to manage some $3.7 trillion.

Of course, few SRI funds are bold enough to claim that investors accept profits purely in the form of social and environmental gains rather than money. Such funds now command sizeable volume primarily because they promise to deliver as good or better financial returns than conventional funds. The longest-running SRI index, the FTSE KLD 400, averaged returns of 9.51 percent from 1990 through December 31, 2009, compared with 8.66 percent for the S&P 500 over the same period. A report by the Social Investment Forum in 2010 showed that the SRI sector has been enjoying healthy growth through-out the downturn.

The SRI concept rests on a belief that it is possible to place a dollar value on an ecosystem, be it a rainforest or wetlands. Indeed, SRI proponents argue that monetizing ecological wealth is the only way to save it. Critics point out that this takes us still further away from a society based on the intrinsic value of natural systems and our interdependence. Clearly there is need for rigorous dialogue between proponents of both approaches.

Underlying efforts to re-value investment is an abiding uneasiness with the idea of perpetual economic growth. Recently, an intellectual movement has sprung up around the idea of “degrowth,” whose premise is that the widely shared goal of national economies—consumption-driven expansion without end—has put the global economy on a dead-end track. Its astonishingly simple argument—that growth cannot continue forever—runs counter to the assumptions of nearly all of today’s economic models.

In March 2010, the Second International Conference on Economic Degrowth for Ecological Sustainability and Social Equity was held in Barcelona and attended by 500 academics from 40 countries. Its premise was that the crisis of 2008 has conclusively established the failure of an economic model based on perpetual growth. “A process of degrowth of the world economy is inevitable and will ultimately benefit the environment,” says a declaration adopted at the conference. “The challenge is how to manage the process so that it is socially equitable at national and global scales.”

Of course, proponents of degrowth are the first to admit that they do not yet have a coherent vision for how societies would plan and manage such a paradigm shift. But degrowthers are part of a larger collection of entrepreneurs, financiers, environmentalists and philosophers who are looking for ways to address the underlying flaws in our current systems.

In cities all over the world—but especially in the burgeoning economies of the developing world—groups of like-minded thinkers are collaborating on the search for a new path. One example is the New Constructs collective, an online forum launched by Sudhakar Ram, CEO of Mastek, a Mumbai-based IT solutions company. After the meltdown of 2008, Ram found many of his peers quietly acknowledging the flaws of the old game but unwilling to challenge it openly. “Most people still see the need for a new game,” he says, “but feel they can’t afford to be pioneers.” So he decided to tap this tentative willingness to look for new possibilities and initiated New Constructs as an open web-based forum where professionals exchange information and collectively rethink familiar assumptions. Today, the group boasts more than 1,000 members, most of them based in India.

Ram chose the name New Constructs because the old values of the Industrial Age gave us attitudes—towards success, learning, work, consumption, wellness, and governance—that are deeply flawed. Take success. It need not be limited, New Constructs members argue, to material measures such as personal wealth, market capitalization, and GDP. Instead success can be defined by more holistic measures. In this view, a “successful” education would not necessarily be one that positioned a graduate for the highest-paying job, but would be an exploration of purpose in life. A sense of meaning would not be dependent on the quality and quantity of our consumption and possessions. This will no doubt sound romantic or naïve to many. Even an open-minded skeptic might protest that it is no more than a call for replacing objective measures of value with subjective ones—hardly a reliable method.

One of the collective’s most avid participants is William Bissell, the managing director of Fabindia, India’s leading retailer of garments and household furnishings produced by traditional artisans. Bissell admits that the group’s vision is still only semi-formed, but believes they are taking important steps in the right direction. “My sense is that elements of the new constructs will be built around a more sophisticated, more multi-dimensional understanding of value—cost and benefit both at a personal and a societal level,” says Bissell.

CORRIDORS OF POWER

All this feverish thinking can seem feeble, even futile, if you consider the mood in the corridors of power. Immediately after the meltdown in 2008, the World Economic Forum gathering at Davos betrayed some signs of introspection. But it was mostly about mechanics, not fundamentals. Among the Davos set, human beings continue to be seen as consumers first and citizens later. From the Davos perspective, the world is first and foremost a place of markets, not societies. There are, of course, members of this elite who are committed to the goal of altering economic patterns in favor of social equity. Yet they remain trapped in a separate silo from those grappling with civilizational values.

This division is starkly evident in the mind-sets of young people who are working as “social entrepreneurs” striving to eliminate poverty and protect the environment. While their more conventional peers are climbing the corporate ladder, sharply focused on profits, the proponents of “social” enterprise seek to start businesses that use the market mechanism to address problems that are otherwise either neglected or left to governments: health, education, access to water, environmental regeneration. Though highly qualified and talented, these young people have rarely been encouraged to reflect on a civilizational basis for defining value.

But I am hopeful. In the scores of conversations I’ve had over the years with groups of young entrepreneurs, I have invited them to consider which of two options might be more fulfilling and have the best prospect of building a stronger global economic foundation, less susceptible to future meltdowns.

Do they see themselves, I ask, as problem-solvers, tinkering within the given frame of reference? Or do they see themselves as builders of a civilization capable of fulfilling a deeper purpose? Inevitably, many faces in the room are puzzled. After all, it’s so rare to be asked to think about civilization. But other faces light up with a new excitement. The same people also tend to become quiet and reflective when I bring up the most oft-repeated quote from Hind Swaraj: “Civilization is that mode of conduct which points out to man the path of duty.” How, they ask themselves, do we match this with all our training, which depicts life as a market place, as a dance of supply and demand, governed by minimal rules to ensure order?

There are no ready-made answers on how this epochal effort should unfold. No comforting alternative dogma waits in the wings. Old ways of thinking seem immutable because new paradigms are not yet equipped with clear formulations or solutions. But what emerges from this period of introspection does not depend so much on dazzling original ideas. Realigning our worldly projects with civilizational purpose depends entirely on those whose honesty will not be compromised by ideology or held captive by prejudices and pet assumptions. Indeed, perhaps the most precious skill in this context will be the ability to live with ambiguity and ambivalence while cultivating self-awareness. This need not involve recourse to morally demanding philosophers like Gandhi. The sixth century B.C. Chinese military strategist, Sun Tzu, left behind the dictum that success depends on knowing yourself before you know your enemy. Recovery to business-as-usual is the enemy. Our current wilderness—economic and social—is a space where we can come to know ourselves better.

*****

*****

Rajni Bakshi is a Mumbai-based writer. Her most recent book, Bazaars, Conversations and Freedom (Penguin Books India) profiled economists, entrepreneurs, and social activists who challenge free-market orthodoxy.

[Illustration by Marshall Hopkins]