By James H. Nolt

Last week, I wrote about the Sanders campaign and its theme of growing inequality. The same evening that blog went live I attended a private meeting of the World Economic Roundtable at the Harvard Club in Manhattan. The theme of the speaker, Lord Adair Turner, was how the unsustainable growth of private debt contributes to both economic instability and inequality, the twin themes of my previous blog.

Turner has a new book just out, “Between Debt and the Devil,” drawing on his unique experience as a private banker and then the chief bank regulator in Britain during the 2008 world financial crisis and its immediate aftermath. His perspective on the financial crisis of the recent past and the prospect of further financial crises in the near future is similar to my own.

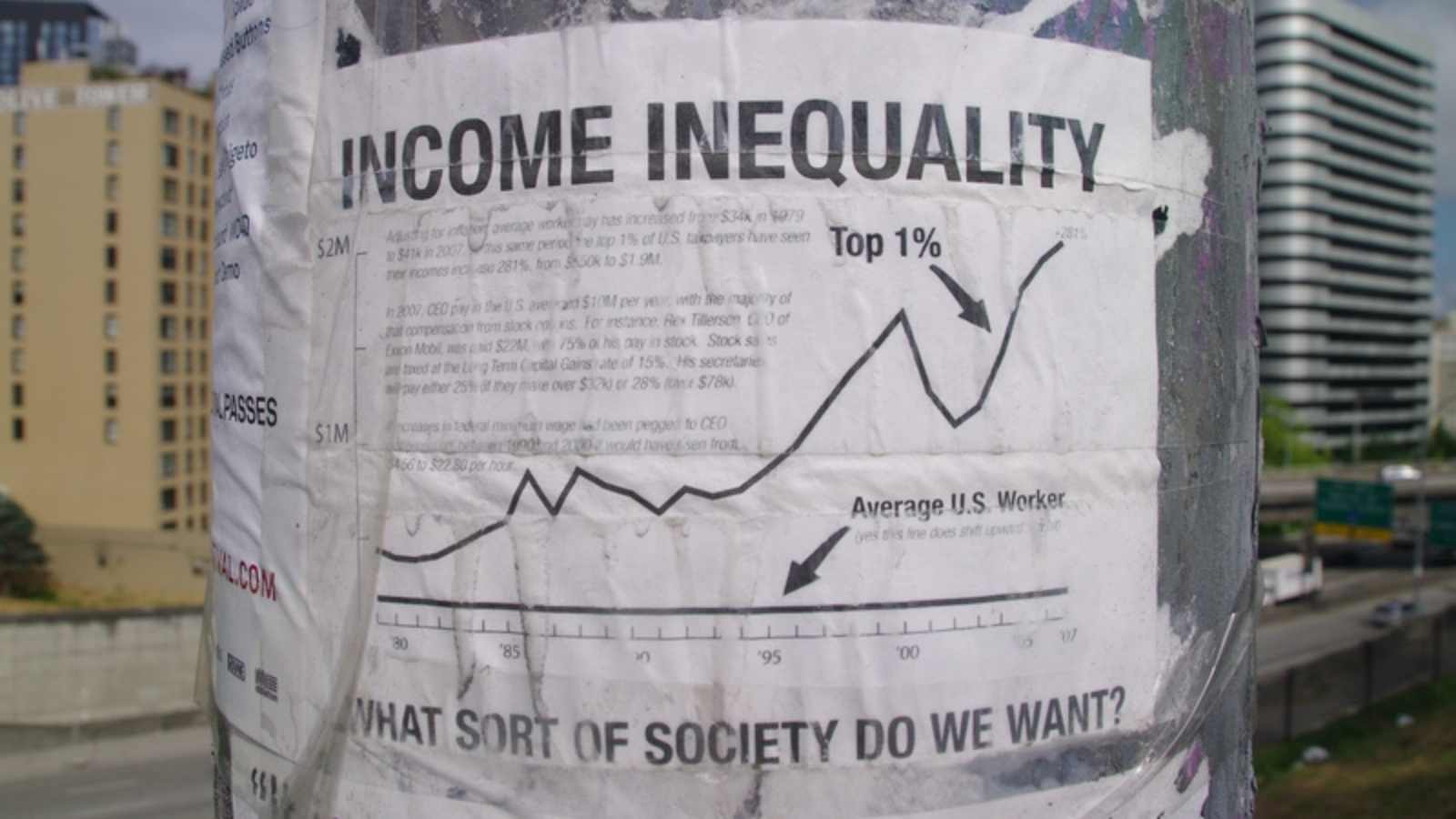

Turner puts the recent financial crisis in the context of the last couple centuries of history. His data show that private debt tends to grow faster than the overall economy. As debt grows relative to GDP, inequality increases because more income is devoted to debt service and throughout history, the rich own a disproportionate share of society’s debts. His perspective dovetails with that of Thomas Piketty, which I also discussed last week.

It is not just the overall growth of debt that matters, Turner argues, but also that what grows the fastest is the wrong type of debt. According to the textbook view of mainstream economics, people save money and banks recirculate those savings as loans to finance productive investment. Turner says if this textbook fable were broadly true, there would not be such a severe problem.

But it is not true. Instead, the majority of bank lending throughout history is to purchase not newly-produced capital goods, but already existing assets, including (and especially) real estate. The more lending there is, the higher real estate prices climb.

From the standpoint of banks, lending to customers to buy assets like real estate seems straightforward. Land purchased with the loan serves as reliable collateral for that loan. It is safer than lending to a business. Businesses must be studied carefully to determine their potential value, but are subject to all sorts of potential risks. Real estate, throughout most of world history, seems a safer investment.

The data in Turner’s book show that real estate loans have tended to grow as a share of all private loans in all major countries, particularly in recent decades, while loans to corporations for productive investment are a small and declining share of the total.

In effect, what banks do is create a self-fulfilling prophecy. They lend more and more money to purchase the same fixed supply of real estate. As lending keeps increasing, new buyers continuously bid up the price of properties. As property values soar, the collateral for the growing loan volume is growing too. It seems like a win-win game: banks get richer from increasing lending and property owners get richer as the value of their properties soars.

But of course, as I have always emphasized in this blog, every direction of the economy creates both winners and losers. The losers are the new buyers entering the market for the first time and finding that their incomes are not rising as fast as the cost of properties. The losers are also the poor, those without property. More and more of their income is eaten up by rent, but buying a home becomes prohibitively expensive. The gap between the property-owning haves and the have-nots consequently keeps growing.

Even at today’s extremely low interest rates, home purchase prices have risen so high that fewer Americans (and fewer people in other major countries too) can afford to buy a home. The percentage of Americans owning their own home peaked during the last financial crises. Since then, millions have lost their homes to bank foreclosures and fewer young people can afford to own a home. So the rate of home ownership, though still fairly high, is now dropping. This is one index of what Sanders calls the ‘disappearing middle class.’

The growth of private lending is simultaneously the growth of inequality. Contrary to the textbook myth, surprisingly little private lending stimulates new jobs through productive investment. Most of it instead enriches property investors like Donald Trump. Unless Trump works against his own financial interest, he is very unlikely, if elected president, to implement the sort of policies Turner advocates to slow down this runaway spiral of lending that makes the rich richer.

There is almost no limit to how much wealthy people and corporations will be willing to spend to locate their homes and offices in the choicest parts of the most expensive and desirable cities. As long as loans against real property are easy to secure, this game will ratchet up prices almost indefinitely.

The only limit is how much wealth can be squeezed out of the hands of the rest of us who actually produce society’s useful output. The most desirable location in the world can only be purchased with a share of the wealth societies produce. If the share of societies’ output required to purchase Park Avenue penthouses and midtown Manhattan office space keeps growing, then the middle and working classes will get squeezed. Homes owned by the middle class may also increase in value, but usually not as fast as the residential and commercial property in the choicest locations, typically owned by the top one percent.

There are two ways to reverse this process. One is financial crisis. Turner shows that indeed a major financial crisis like 2008 does wipe out large amounts of wealth and bring down property prices. But if lending resumes in the same pattern as before, prices are bid back up and the wealth of the very rich recovers, along with property values, though the income and employment of average people often does not keep pace.

The alternative to having price “corrections” in the form of a boom and crash cycle is to use taxes to restrain property booms. There are several ways to do this. One is to have a progressive tax on property, the way many countries now have (at least in theory) a progressive tax on income. Then as property prices rise, taxes rise even faster and tend restrain the price increase. Another way to restrain the growth of debt-fueled price bubbles is to tax the loans that fuel them. A tax on unproductive capital (i.e., capital not invested to greater new jobs and production) is another possibility.

The political climate of American politics today is very averse to taxes on wealth, which is exactly why this country and others like it are very susceptible to property price bubbles that hit heaviest on young people, the poor, the one third of Americans who do not own a home. This is the natural base of the Sanders campaign. The real challenge is to expand the popularity of progressive taxes on unproductive capital and property to mobilize the support of a majority big enough to win elections and fundamentally change public policy.

*****

*****

James H. Nolt is a senior fellow at World Policy Institute and an adjunct associate professor at New York University.

[Photo courtesy of mSeattle]