By James H. Nolt

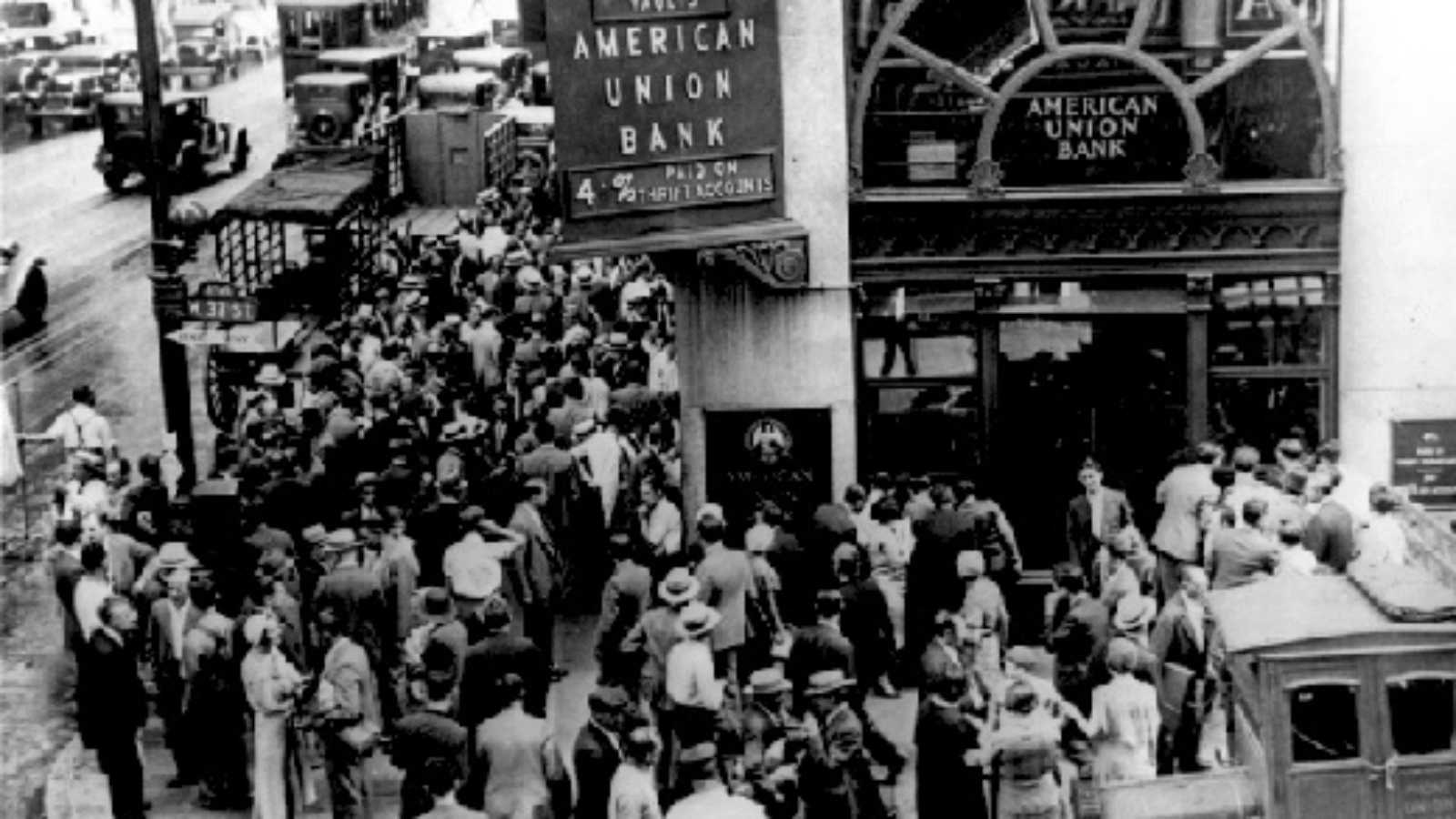

Last week I promised to begin this week by exploring some real crises. I will start with one that has become iconic: the great stock market crash of 1929. In fact, it is not as unique as it seems. Crashes of this sort have occurred in every country with financial markets throughout human history. Their magnitudes were large, but their anatomies are all too typical.

Like all booms, the one that ended in 1929 involved both real growth and a financial bubble even more expansive than the growth itself. The bullish frenzy of the boom years is celebrated in the phrase “the Roaring Twenties” and in classic literary treatments such as F. Scott Fitzgerald’s The Great Gatsby. But whereas many popular accounts treat the Great Crash primarily as a morality tale, the fable is shorn of the strategic dynamic that animated the boom and bust cycle then, as always.

The boom was powered with some real business opportunities that required massive infusions of capital to flourish, notably the automobile and radio, plus the related businesses these innovations stimulated, such as oil, travel, and advertising. Less well known to the general public but nevertheless highly significant was the revolution in the chemical industry pioneered in Germany with the inexpensive mass manufacture of ammonia, leading to a proliferation of products, including fertilizer, textile dyes, high explosives, plastics, and artificial fibers, such as rayon and nylon.

Added to these technological advances was the restoration of peaceful global commerce after the horrendous bloodbath of World War I. In 1921, a steep crash followed the inflationary boom of the immediate postwar years, but most of the decade of the 1920s featured a long boom as investment flooded into new industries and into reconstructing the wartime damage and depreciation. The boom years spread the habit of investing to a broader segment of the public. For many people, including leading pundits, the boom became “the new normal.” Yale economist Irving Fisher infamously pontificated just three days before the crash, “stock prices have reached what looks like a permanently high plateau.” Like so many bulls, he personally lost a lot of money.

As in all booms, the financial ascent was accelerated by the liberal application of credit. It became very common to buy stocks “on margin.” Suppose you have $500 to invest. If the RCA stock you want to buy is $100 a share, you can buy only five shares. But the broker can stimulate greater business and take advantage of your bullish optimism by offering you a loan. You might add a broker’s loan of $4,500 to your own $500. Thus you can buy 50 shares instead of only five. Now, if the value of your fifty shares of RCA increases a mere 10 percent to $5,500, instead of making 10 percent return (if you had used only your own capital), you make ten times more: 100 percent return on your initial capital! If you sell the stock at that higher price, you can pay back the loan, while doubling your money. It is a bull’s dream.

The broker has every incentive to lend you money to buy the shares because your shares then become the collateral for the loan. Furthermore, the broker makes money on the volume of stock he sells, so the more loans he makes the greater volume he sells. His commission is multiplied, and he earns interest on his lending too. All the credit-fuelled buying tends to create a self-fulfilling prophecy of ever-rising stock prices as more and more buyers leverage their purchases with debt. Demand is hot! Every boom in history is pumped up in a similar manner.

This bullish fiesta looks like a win-win game, as business argot would have it. There is, of course, a fly in the ointment. Asset prices rising so much faster than real production means that financial claims are exceeding the economy’s ability to deliver real goods. Asset prices may be inflating to such an extent that money is losing its value. All the nouveau riche may be spending not just on stocks, but, feeling rich, they are buying more of everything—more champagne, fast cars, and jazz performances. Businesses buy new machines and additional raw materials to expand their capacity to produce since they can sell additional stock at high prices, making it easy to finance expansion. Rising prices, as we explored last week, mean the value of money is falling, which also means that the value of debts, such as bonds and mortgages, is also falling in real purchasing power. Many creditors will be unhappy. The bulls are partying. The bears are not.

But the bears have a power few people notice, until it hits them. Bears control credit more than they need it. They know that if credit is curtailed, the bulls’ party will come to a crashing end. The story has various ways of playing out. Either the big banks curtail credit to brokers, forcing them at least to call in their loans to customers and sometimes into bankruptcy, or some of the brokers notice tightening credit and switch to the bear camp before most of their customers do.

Brokers are in great shape at the peak of a boom to switch strategies. They may solicit investors willing to gain some additional income on their stocks by lending them, at interest, to the brokers. Brokers then sell these immediately into the still rising market. Now they have a short position. They will profit when the price falls. So they advise their customers, “The market has peaked, sell now while you can!” They whisper to fellow brokers, “I am short; you should be too.” Investors selling to lock in their profits and others borrowing stock to sell it short all create additional downward pressure on stock prices. If this pressure is big enough and the rumor-mongering plausible enough, price jitters signal a peak may be turning down. The bear party gains momentum, and short positions multiply.

What happens next is not always according to the expectations of the shorts. Sometimes buying pressure is still too strong to overcome, and the price rise continues, squeezing the shorts. However, if they were right about credit being tightened, chances are that others too will perceive that bullish leverage is drying up. Leveraged bulls panic and sell, leading to collapsing prices. Furthermore, since many of the loans to buy stock are issued by brokers themselves, obviously any broker with a short position stops lending. The power of his position is that even if his customers are bankrupted, he recovers their stock, which was the collateral for his loan. This collateral may have depreciated, but this may be more than compensated since his short positions will pay handsomely when he buys back the stock at the depressed market price and returns it to the unhappy investor from whom he borrowed it before the crash. Credit tightening validates the bears’ predictions, which are not entirely guesswork since they are the ones making the credit decisions! Next week we will see why failure to perceive bearish strategies misleads even the greatest philosophers and economists.

*****

*****

James H. Nolt is a senior fellow at World Policy Institute and an adjunct associate professor at New York University.

[Photo courtesy of Wikimedia Commons]